Air Circulation: Key to Home Mold Prevention

Home mold prevention relies on understanding and modifying environmental conditions conducive to mol…….

Home mold prevention relies on understanding and modifying environmental conditions conducive to mol…….

Non toxic mold remediation is a popular and safe approach to eliminating mold, addressing health ris…….

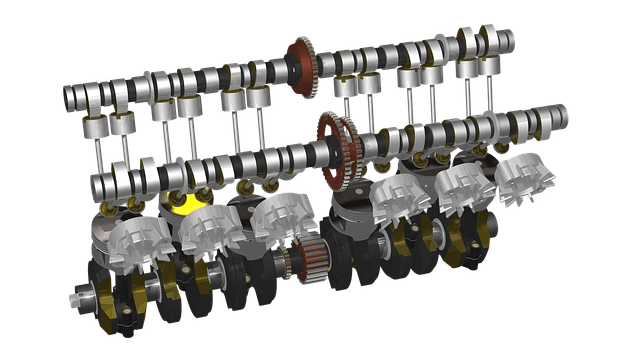

The tanker dome leak simulator is a critical tool for cargo tank training, offering safe, controlled…….

Fire safety training using hands-on simulators with emergency response props improves firefighters&#…….

The firefighter dome clamp simulator is a specialized training tool that safely replicates emergency…….

The Hazmat Valve Training Simulator is a revolutionary tool for immersive emergency response trainin…….

Tank truck rollover simulators revolutionize hazmat team training by safely replicating real-world s…….

Portable tank truck simulator systems revolutionize Hazmat training by providing immersive, controll…….

Emergency valve training simulators offer safe, controlled environments for firefighters to practice…….

In rural areas with unique challenges like narrow roads and uneven terrain, understanding tank rollo…….